|

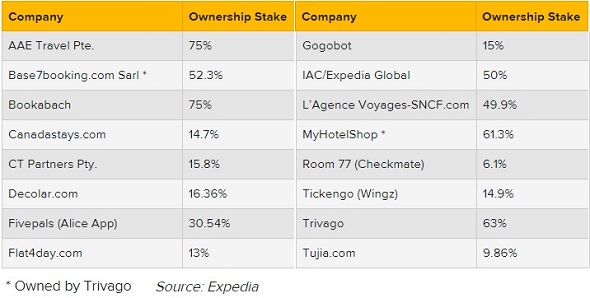

In an exhibit that was part of its annual report, filed with the Security and Exchange Commission February 11, Expedia revealed that in 2015 it took a 30.54 percent stake in the hotel management Alice App (officially known as Fivepals), 14.9 percent in the airport ride-sharing app Wingz (Tickengo), and a 16.36 percent piece of the Latin American online travel agency Decolar.com, which also operates Despegar.com.

Previously we knew that Expedia led a $9.5 million Series A round for the AliceApp but Expedia’s 30.54 percent wasn’t revealed at the time. We knew that Expedia led an $11 million Series B for Wingz but Expedia’s 14.9 percent stake hadn’t been disclosed. When Expedia deepened its 13-year-old relationship with Decolar in March 2015, the companies revealed that Expedia made a $270 million minority investment but now we learn that it amounted to a 16.36 percent piece of Decolar. Expedia lists more than 250 subsidiaries in the exhibit it filed and there were 15 listed in which Expedia owns a minority, 50 percent or majority stake. [See chart below.] In addition to the 2015 investments in Alice, Wingz and Decolar, some of the more recent investments include 2014 investments in Checkmate/Room 77 (6.1 percent) and Gogobot (15 percent). Expedia’s Gogobot investment is actually a byproduct of Expedia’s acquisition of HomeAway; the vacation rental site led a $20 million Series C round for Gogobot. Expedia’s other investments range from a 49.9 percent stake in a joint venture dating to 2001 with the rail line SNCF in French online travel agency L’Agence Voyages-SNCF.com to a 15.8 percent piece of Sydney, Australia travel agency CT Partners Pty. Several of the investments are actually owned by Trivago, of which Expedia wields a 63 percent stake. In the wonky world of corporate names, Expedia does not list Travelocity, of which Expedia owns 100 percent, as a subsidiary; Travelocity is listed under its official name, Travelscape. Expedia’s Investments in Subsidiaries through 2015

|